4 Issues Holding Back Effective Attribution in the Travel Industry

As travel marketers currently adjust to meet the impact of COVID-19 and the knock-on effect on both customer buying behaviour and their marketing budgets, the need to accurately account for the contribution of every marketing activity has never been more important.

However, evidence points to the fact that travel marketers are still not able to attribute and account for the impact of their actions in the way they would like.

So, what’s holding them back? We think there are 4 key reasons:

1. Lack of access to appropriate attribution models

At the most fundamental level, travel marketers are being held back by outdated attribution models that aren’t fit for purpose in today’s complex environment.

In fact, our own research has uncovered the fact that 90% of those responsible for improving marketing ROI in the UK are struggling to access the type of sophisticated models they need to connect media impact with revenue.

In a tmarket heavily impacted by COVID-19, travel brands are scrambling to maintain engagement with customers and increasingly using a wider range of media to connect with, inform and reassure them to convince them to book ahead of time. Add in the fact that customers are using multiple devices – 40% research travel on a mobile but buy on another device – and you have a complex attribution puzzle to unravel.

In this environment, rules-based attribution models like First-click and Last click, with their heavy bias to the front and back end of the customer journey – are simply anachronistic.

Their impact in recent times within the travel sector has been to over-attribute the impact of media like paid search. Savvy travel marketers are seeking out attribution solutions that accurately assess the impact of all touchpoints across the customer journey – which provide a much more accurate assessment of ROI that can be used to adjust spend.

And, crucially, optimise future revenues.

2. Poor quality of the underlying data being used for attribution

A second issue is the quality of the data that travel marketers are feeding into their marketing attribution analysis, which is often poor in the first place.

The nature of travel marketing spend means that marketers are very often heavily dependent on sourcing data from channel partners like Facebook and Google. The challenge in this model is that you can encounter very real data issues even before you get to the attribution stage.

And for marketers who are using models like First and Last-Click in Google the concerns are very real.

This is because the very nature of the way that Google collects digital marketing data is problematic because it is based on a session-based approach (cookie/pixel tracking) where a device accesses a web property. Not on identifying an individual user who uses multiple devices on their buying journey.

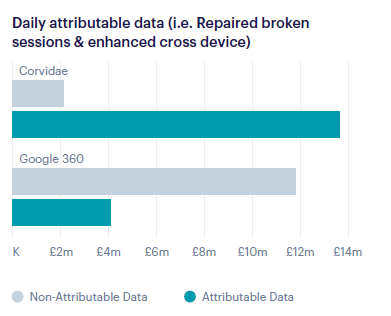

In the above example, Corvidae took existing Google 360 data and effectively rebuild it for a client. And adjust the level of attributable spend from £4.1m to £13.6m in the process.

Poor quality data is hurting your attribution. Here’s why…

3. Internal data silos are making things challenging

“In 2021, it’s predicted that you’re going to have about 30% more data in silos than we had as marketers back in the days of 2011 and 2010. Back then, digital spend was predominantly with Google and in paid search.”

Chris Liversidge, CEO at Queryclick

Nowadays, however, there are an increasing number of isolated channels that travel marketers must choose between for investment, including the likes of Facebook and programmatic display.

The emergence of these new media channels is somewhat of a double edge sword for travel marketers:

- On one hand, they offer the ability to reach customers in a host of different ways that weren’t previously possible and to get your brand in front of them more of the time.

- On the flip side, more often than not, they are run along departmental or channel-based lines – building up separate silos of data that either don’t connect or simply aren’t available to other channels.

This is clearly problematic in that channels like search, programmatic, social, outdoor display and TV/radio are effectively responsible for “marking their own homework”. Which inevitably leads to over-reporting on channel effectiveness and over-valuing revenue and ROI.

Add in the complexity of the “walled garden” approach that social platforms like Facebook and Amazon have to data availability for analysis outside of their own analytics platforms and you begin to understand the challenge around unifying your cross-channel analysis around a single data source.

Here’s how to unbundle your Google Ads and Facebook data for attribution success…

4. An inability to see right across the customer journey

According to Mintel’s Travel Industry report, the type of travel being booked is likely to influence the time you spend on researching and booking online. With up to a week being the norm for domestic or short breaks and anything from 1-3 weeks, or even more, for overseas trips.

And depending on which data source you choose to believe all of them point to buying cycles that are longer, more complex and on a wider range of devices than ever before. As we pointed out earlier simple attribution models like First-click and Last-click are simply not up to the job of analysing these effectively.

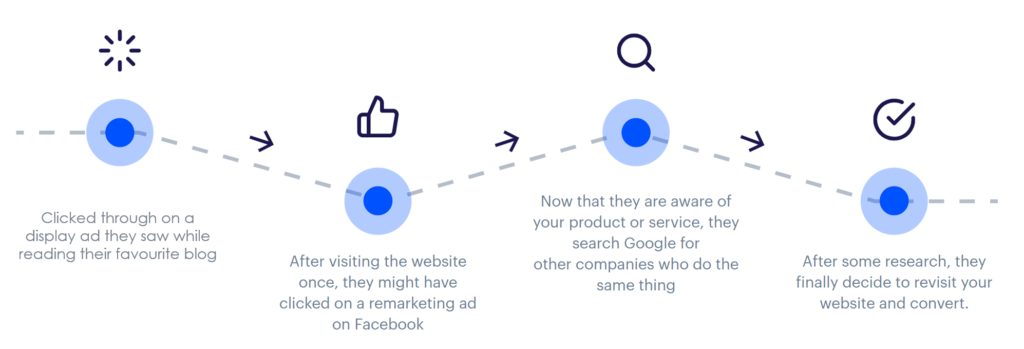

Let’s take the example below:

- A traveller decides to book themselves a holiday and so conducts an initial Google search for destinations on their mobile.

- Based on the search, they find a great article on your blog about holidays in Corfu and quickly check some initial options on your website before leaving without booking.

- They spend some time over the next week or so drifting around other sites looking at other providers on a combination of mobile and tablet.

- They then click through on your Facebook advert for the same holiday in Corfu but again don’t book.

- A week later they sit down at their desktop to do some final checks, search on Google for the Corfu holiday and your brand name and then click through on a PPC ad to book the holiday.

If you’re using First-click or Last-click for attribution then either the content on your blog or the PPC ad would get 100% of the credit for conversion. The reason being that they are only looking at a very small part of what is, in practice, an extended journey. With a wide range of touchpoints that all contribute in some way to conversion – and that need to be accounted for in your attribution analysis.

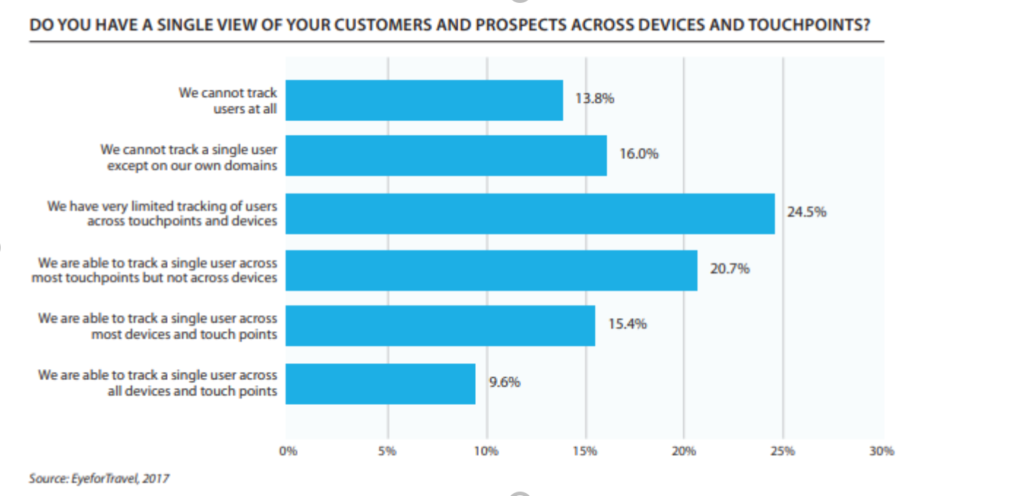

What you have is a single channel focused view of conversion, when what you really need is a single view of the individual customer journey across all touchpoints and devices. However, as EyeForTravel report, the majority of travel marketers are struggling to get the view of this they need with only 9.6% reporting they are able to track a single user across the devices and touchpoints they need.

A challenging environment means that travel marketers need to understand the impact of their activities more than ever before. But a combination of factors including lack of access to appropriate attribution models, poor quality underlying data, channel specific data silos and an inability to see individual customer journeys are holding them back.